Insurance Company Triples Return on Investment

Transforming the customer experience and reducing costs

3X

return on their investment

300

million customers served

1/3+

agents shifted to remote model

Insurance Customer Case Study

Customer Service Teams See Drastic Productivity and Engagement Improvements

Challenge

Two years before the pandemic, this Fortune 500 global insurance company that serves over 300 million customers worldwide refocused on innovation. Relying on traditional software was not helping them meet their contact center cost savings and productivity goals. While the team knew that deploying tactics to reduce handle time or keep adherence metrics in check would reduce cost, it was impossible to keep up with constantly changing conditions and the massive amounts of data generated within the center. Their team could not react quickly enough to make a consistent impact.

“Intradiem has been and will continue to be mission-critical technology for managing our contact centers – for the brick and mortar and virtual environments. The ability to monitor and act in real time is a game-changer for improving operational efficiency and employee engagement.

– VP, Forecasting, WFM Analytics

Results with Contact Center Automation

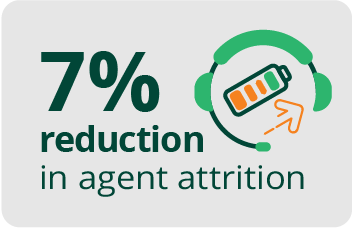

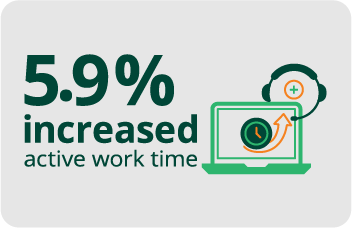

The automation platform directly alerts agents if they exceed handle time thresholds, ensures agents remain on schedule to keep adherence in check and identifies optimal times for training. The first two years of deployment yielded a 3X return on their investment in contact center automation.

Approach

The company deployed Intradiem’s automation technology for their customer service team. The team set up business rules within the call center automation solution to monitor center conditions and all data points – in real time. The technology integrates with the Automatic Call Distributor (ACD) and Workforce Management (WFM) systems and immediately triggers actions to improve operational efficiency.

About the Solution

The abrupt transition to a virtual contact center, while challenging, demonstrated that their team of people and the technology already in place provided a good foundation for a successful move. With a third of their agents already working from home, the company had a solid virtual footprint.

The customer service team felt like having call center automation was mission-critical for managing a remote workforce – not just for improving productivity –but also for improving agent engagement. Supervisors cannot visibly see when their teams are struggling when their team is all working from home. They relied on automation to identify and notify agents and supervisors when the optimal time for 1:1 coaching occurred – eliminating the need to schedule the time in advance.

Management also had good visibility into agent activity and performance and could quickly identify which agents needed extra coaching.

Trusted By:Trusted By: